Market Manipulation

Share this article

Is market manipulation a matter of who's doing it?

“It is a well-known urban myth that the French don't trust banks and store their money under their mattress. It's not that they are tight with money they just don't trust anyone.” ― Janine di Giovanni

I spent a weekend in Paris wandering around modern art fairs—a classic ‘insiders’ market—when I got to thinking about market manipulation.

Henry Ford once said “speculation is only a word covering the making of money out of the manipulation of prices, instead of supplying goods and services.” Was he right?

Or is the answer different depending on who is at it? Art in France, for example, does not count as taxable ‘wealth’, or at least it won’t while the family of France’s foreign minister have an inherited art collection.

Hedge funds get a kicking by the media (and politicians) whenever they are seen to be ‘speculating’—elephant memories of Black Wednesday—and yet when governments interfere with their own currencies, it is called monetary policy or more opaquely, ‘mercantilism’.

Quantitative easing is a useful tool but have some nations become a little too addicted to it? It is a slippery slope from QE to stock market manipulation, which Stephen Roach suggests is now standard operating procedure.

If negative interest rates become the norm for the everyday saver, it won’t be just the French putting their money under the mattress. Swiss cash on deposit now costs the investor money, and we are not far away from the day that everyday savers around the world may have to pay to keep their money on deposit.

Is something wrong with this picture? Today, developed nation government securities are at record low yields. Earlier this year at the Milken Institute Global Conference, one manager said it was ‘just crazy’ to hold bonds with negative yield, reiterating recently there is no longer a taboo about negative rates.

The heart of capitalism is the fairness of markets and (fiat) currencies; mess with that and the financial market compass loses its bearings. Banks have learned this the hard way: manipulate LIBOR and you will be fined; manipulate foreign exchange and you will be fined, unless of course it is during a credit crisis, when central banks need to demonstrate that banks have no funding issues, but that is another story.

Over the summer when the Chinese Yuan dropped by a cumulative 4.4% against the US dollar opinion was divided as to whether or not what had happened was good or bad, as there is no international agreement on what constitutes currency manipulation. Almost overnight China was able to export cheaply; if the FX drop was a move towards a free market economy or currency manipulation is actually just a point of view.

But it was this summer’s stock market crash in China that saw the international market criticise the Chinese leadership for failing to manipulate the stock market effectively, in other words so that international investors could preserve a greater portion of their last 12 months' gains.

Market manipulation is deemed acceptable when it goes ‘our’ way; asset owners have to admit that they have enjoyed the benefits of central bank manipulation of global money markets for the past seven years. But hold cash—as some 30% of UBS clients did at the start of 2014—and the scene is not so pretty.

The effect of a public loss of trust in the mechanics of money and markets is highlighted in Adam Fergusson’s book When Money Dies. Adam Smith’s recount in Paper Money is also pretty graphic. In 1914, Germany was a country that had a gold-backed currency that was worth four or five to the dollar, but by 1923, the Mark was one trillion to the dollar and a wheelbarrow of money could not even buy a newspaper.

Central banks have done a remarkable job of stabilising the global economy, since the unforeseen consequences of the repeal of Glass-Steagall brought us to the brink, but has this really restored our confidence in markets or simply made us addicted to governments’ market interventions.

The LIBOR rigging scandal shook the foundations of finance. Earlier this year, the European Parliament started a discussion to ensure the future robustness and accuracy of benchmarks. But if we are in a new age of mercantilism and there is a staggered ‘race’ to depreciate currencies, is that okay? Is it ever really okay to manipulate asset or currency prices? And if so, where does it lead?

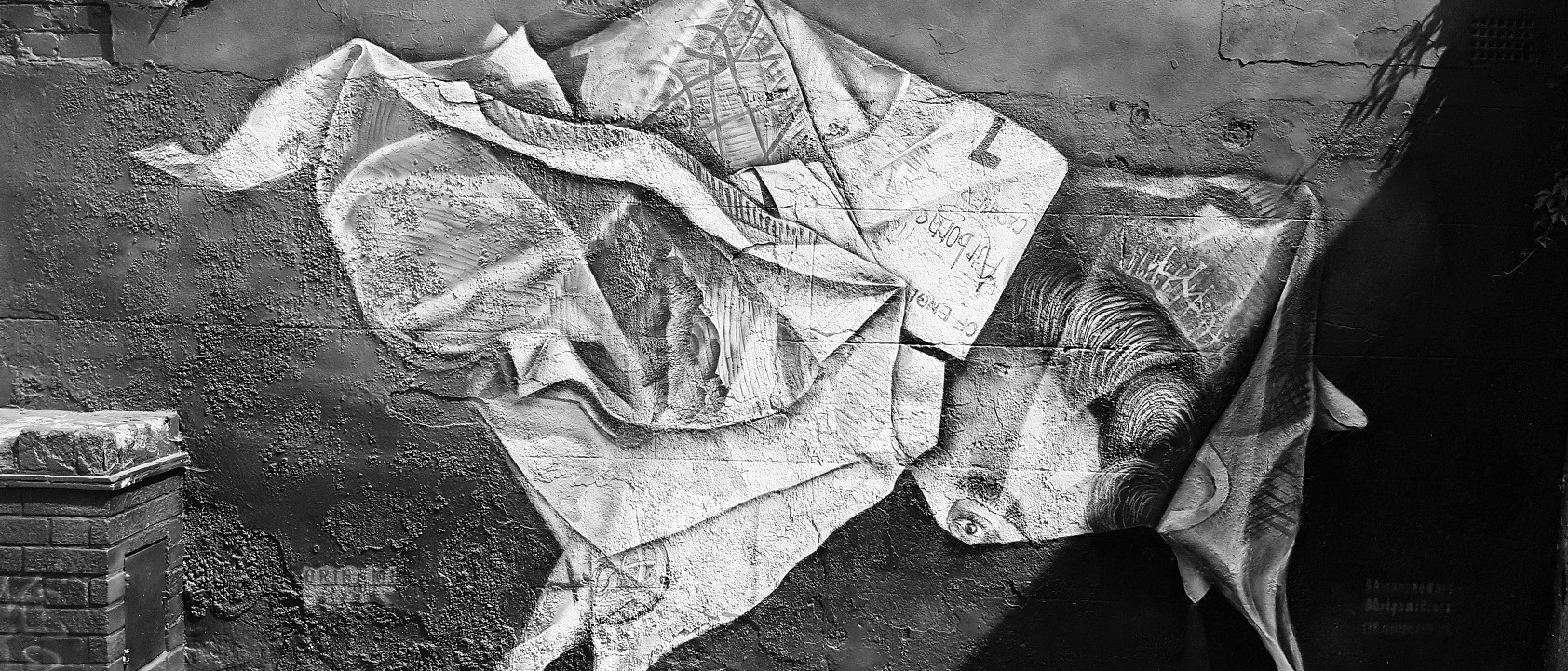

Photo: © Niki Natarajan 2017

Artist: Airborne Mark

Article for information only. All content is created and published by CdR Capital SA. The views and opinions expressed in this article are those of the author(s). Information on this website is only directed at professional, institutional or qualified investors and is not suitable for retail investors. None of the material contained on this website is intended to constitute an offer to sell, or an invitation or solicitation of an offer to buy any product or service. Nothing in this website, or article, should be construed as investment, tax, legal or other advice.

Related articles

In Vino Veritas

Burgundy vs Bordeaux could be the least of the fine wine industry’s problems if Hong Kong’s political situation, Brexit and President Trump’s tariffs of 25% on French, German and Spanish wines continue. Could the global wine market be facing headwinds?

Death & Taxes

As we enter the stage where monetary policy is to be replaced by fiscal policy as a way to right the world’s post-crisis ailments, tax policy is one of the key tools. But it is how much to tax (and whom) that is going to drive the global political agenda.

Classic Cars

Janis Joplin never got a Mercedes Benz, but she did pay $3,500 for a used Porsche 356 in 1968 that sold at auction for $1.76 million in 2015. A return on investment of more than 50,000% over 47 years. But are we at the start of a long-term reversal?