Covid: One Year On

Share this article

Legacy of Lockdown

"Government is not the solution to our problem, government is the problem” – Ronald Regan

We are more than a full year into the Covid era. Much has changed. Are these changes permanent and, if so, which should we be most concerned about? First, a declaration of bias: the most powerful force in finance (after compound interest) is mean reversion. In the longer term, it ‘explains’ more than many other factors.

So, our hunch is that things such as the ‘stay at home’ stocks that have done so well during Covid, such as Netflix and Zoom—and got crushed in positive vaccine news—will succumb to the inevitable force of new entrants and competition.

And sectors such as airlines, energy companies and leisure stocks, which have done poorly, will recover. This rotation has already been in full force during Q1 of 2021. It may have even kicked off a reversal in the decade-long ‘value over growth’ underperformance.

So, it’s safe to assume that restaurants, clubs, bars and cafés will all do well, once they are allowed to open freely. Perhaps cinemas won’t come back but the rest of the leisure industry will.

Airlines and hotels may take longer to recover, since they face a further headwind, namely the accelerating trend to track individual and corporate carbon footprints, but leisure travel should bounce back quicker than business travel.

Many ‘road warriors’ have discovered that whilst deal-closing may be impossible remotely, introductory pitches are better executed virtually, particularly when the full team can be displayed along with the sense of corporate identity and teamwork.

City centres are a mixed bag. The high street seems dead and a combination of tax rises, regime changes and working from home may have dented the vibe of some of the world’s financial centres. Right now, from peak city to ghost towns, New York is close to the top of this list with London a close second. But what about Hong Kong? That probably depends on China (but, then, Google does not track mobility data for China).

And we’ve all had lots of time to think about the future. Saving the planet has come to the top of everyone’s agenda, even if we will take a while to rank the users-of-scarce resources in a way in which we can all agree.

Whilst we are doing this, we’ve coalesced around a view that carbon extraction industries should be starved of capital and whilst we seek ways to transition ‘clean oil’ and ‘green hydrogen’.

It’ll get harder when we get to water and electricity usage because the virtual world, including cryptocurrency mining, is less sustainable than we’d all like to believe, and, yes, electric cars, too.

But there’s a new twist to the capital allocation process. For the first time in our lifetimes (for those of us that haven’t yet experienced communism first hand) money does not inevitably flow to the asset classes offering the best returns.

Added to this, we have suddenly found ourselves, for the first time since the fall of the Berlin Wall, in a bi-polar world. ‘China is now the bad guy’ is the Biden regime’s clearest message. This, plus the nascent vaccine wars in Europe and elsewhere, has turned the race to in-source supply chains to warp speed.

Globalisation, in case you are on any doubt, has slammed into reverse. The Ever Given cargo ship, failing its three-point turn driving test manoeuvre, and getting stuck in the Suez Canal disrupting global trade, is the meme-ready image that made the point.

Some of these changes are unlikely to revert but, in a way, they are just a friction or added cost to business. They’ll show up in reduced returns eventually, but are not critical.

Covid, however, has done tremendous societal damage. The wreckage of education; the regressive nature of employment opportunities; the (non-Covid) excess mortality wave to come as delayed health screens and vital operations take their toll; rifts between sections of society; and between young and old.

All of these aftershocks are yet to attract the attention of the media who are still focused on ICU occupancy and the daily press briefings from the still-behind-the-ball governments around the world.

But the biggest change is how we are governed. We all imagine that our constitution, written or not, protects us from abusive state powers. But it doesn’t. A constitution at its most basic is an idea that allows a government to tax its citizens (now and always, mainly to fight wars) in exchange for some (hard won, incremental) rights.

But all constitutions are (via Supreme Court interpretation or explicitly) about customs. And like taxation, once the state is accustomed to acting in a certain way, it’s likely to continue to do so. And in the US constitution, Gödel’s Loophole, is apparently the way to do it.

As China started locking down its population, Europe looked on in horror. Only a totalitarian state could get away with that. If the gilets jaunes took to the streets over a few centimes on the price of diesel, how could French citizens possibly accept home confinement? But they could and they did.

Not just of the sick or vulnerable. But as Gary Oldman says in Leon “Everyone”. “The ease with which people could be terrorised into surrendering basic freedoms which are fundamental to our existence … came as a shock to me in March 2020,” said Lord Sumption, delivering the Cambridge Freshfields annual law lecture.

Caught in the middle of all of this are the police. Often tasked with operating at the limits of statutory authority in ‘enforcing government rules’ and against a global backdrop of Black Lives Matter and ‘defund the police’, they are on a hiding to nothing.

It might be an unpopular idea, but I’d venture to suggest that the average police person is more trusted than the average politician - and if our societal fears are justified, we may all come to rely on their individual and collective goodwill more than we currently believe possible.

Either that or supplies of private security devices are set to sky rocket. Or micro-dosing anything that makes life a little sunnier. Maybe both. As an aside it is interesting that the French government has turned a blind eye to CBD shops that are now cropping up on every street corner like, to mix a metaphor, mushrooms.

A vaccine passport is, some say, a lesser evil (than continued lockdowns) but it’s a short step to a world of which President Xi Jinping would very much approve. And what if it turns out that some groups are more at risk of Covid than others? Is ethnicity a marker on the passport? Or age? What about educational status?

Four days after the UK went into lockdown last year, Yuval Noah Harari, historian, professor in the Department of History at the Hebrew University of Jerusalem, and author of the popular science bestsellers Sapiens: A Brief History of Humankind, Homo Deus: A Brief History of Tomorrow, and 21 Lessons for the 21st Century, nailed the future.

“Many short-term emergency measures will become a fixture of life. [Emergencies] fast-forward historical processes. Decisions that in normal times could take years of deliberation are passed in a matter of hours. Immature and even dangerous technologies are pressed into service, because the risks of doing nothing are bigger. Entire countries serve as guinea-pigs in large-scale social experiments”.

It is interesting that whole businesses are now devoted to the process of securing nationality and right to reside in countries far away from the place you think of as home or where you’ve made your fortune.

It’s not clear that anyone trusts 'government’ anymore. As Ronald Regan said in 1981: "Government is not the solution to our problem, government is the problem". Although watching the Brits queuing dutifully for vaccines that may not work against their own Covid variant is a heart-warming display of Blitz spirit.

If custom is what underpins our constitutions, citizens need to wake up fast. Government largesse and central bank stimulus has come at a very high price: the post Covid legacy is a constrained supply of raw materials and civil liberties.

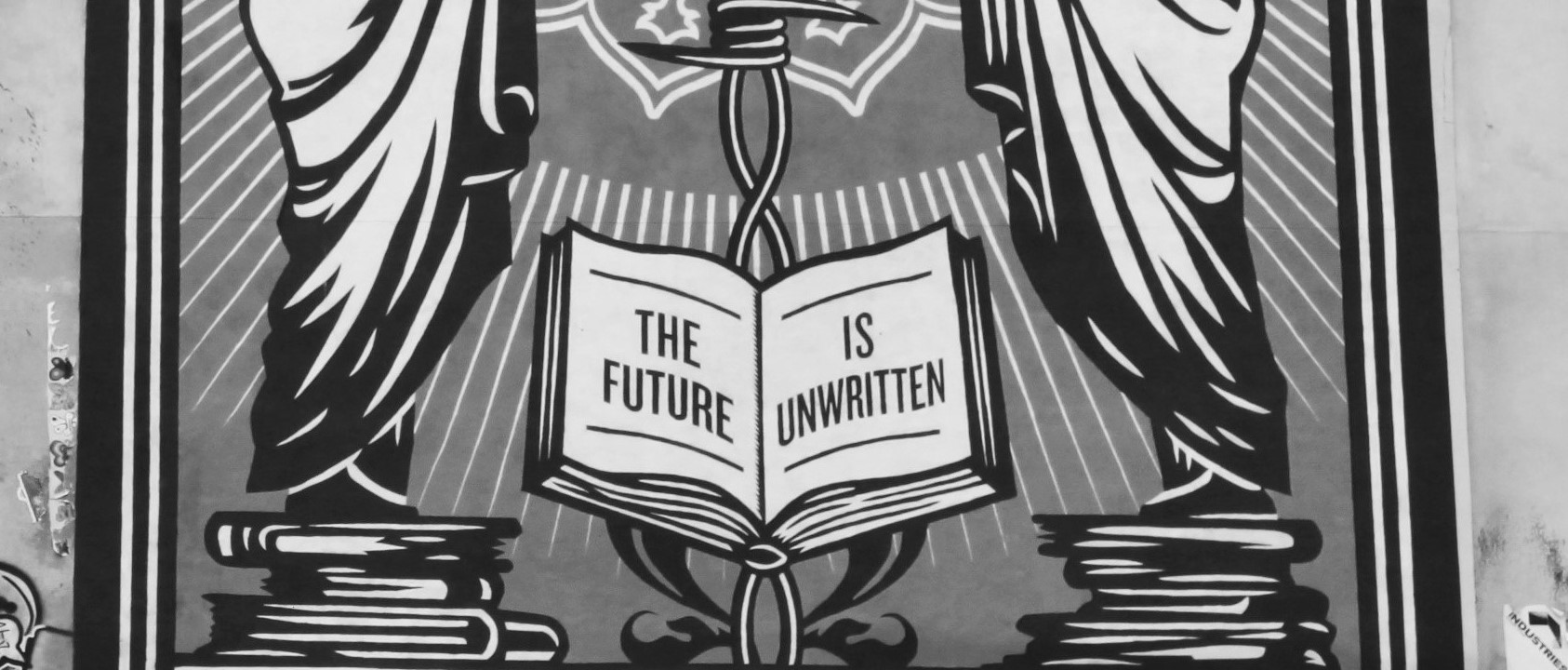

Photo: © Niki Natarajan 2019

Artist: Obey Giant

Lord Sumption attacks government over coronavirus restrictions, Financial Times (27.10.2020)

Article for information only. All content is created and published by CdR Capital SA. The views and opinions expressed in this article are those of the author(s). Information on this website is only directed at professional, institutional or qualified investors and is not suitable for retail investors. None of the material contained on this website is intended to constitute an offer to sell, or an invitation or solicitation of an offer to buy any product or service. Nothing in this website, or article, should be construed as investment, tax, legal or other advice.

Related articles

Re-working Work

Ring lights? A mitigation strategy for the pallor of holiday-deprived employees forced to share the kitchen table during Zoom meetings; the lucky ones. By the end of April 2020, 1.6 billion workers were in danger of having their livelihoods destroyed.

Mind the Gap

Our lives are currently being ruled by statistics. Yet in March, we were as likely to die of Covid-19 by biking for seven miles across a large city or by being hit by an asteroid over a lifetime. What is all this fear doing to our minds and the markets?

Government

Climate crises, plagues, an unwillingness to trade with foreigners and the corruption of democracy: a snapshot of the 21st century or a sign history is repeating itself?