Long-term Client Partnerships

We invest the time necessary to understand fully our clients' goals.

Our independence is critical as we know every client's investment goals and criteria are their own. It means we can advise them on what to do as well as what not to do.

We use our global reach and investment bank-grade models to source, sort, analyse and make sense of the trends and turning points driving the real and financial world.

The CdR Investment Journey

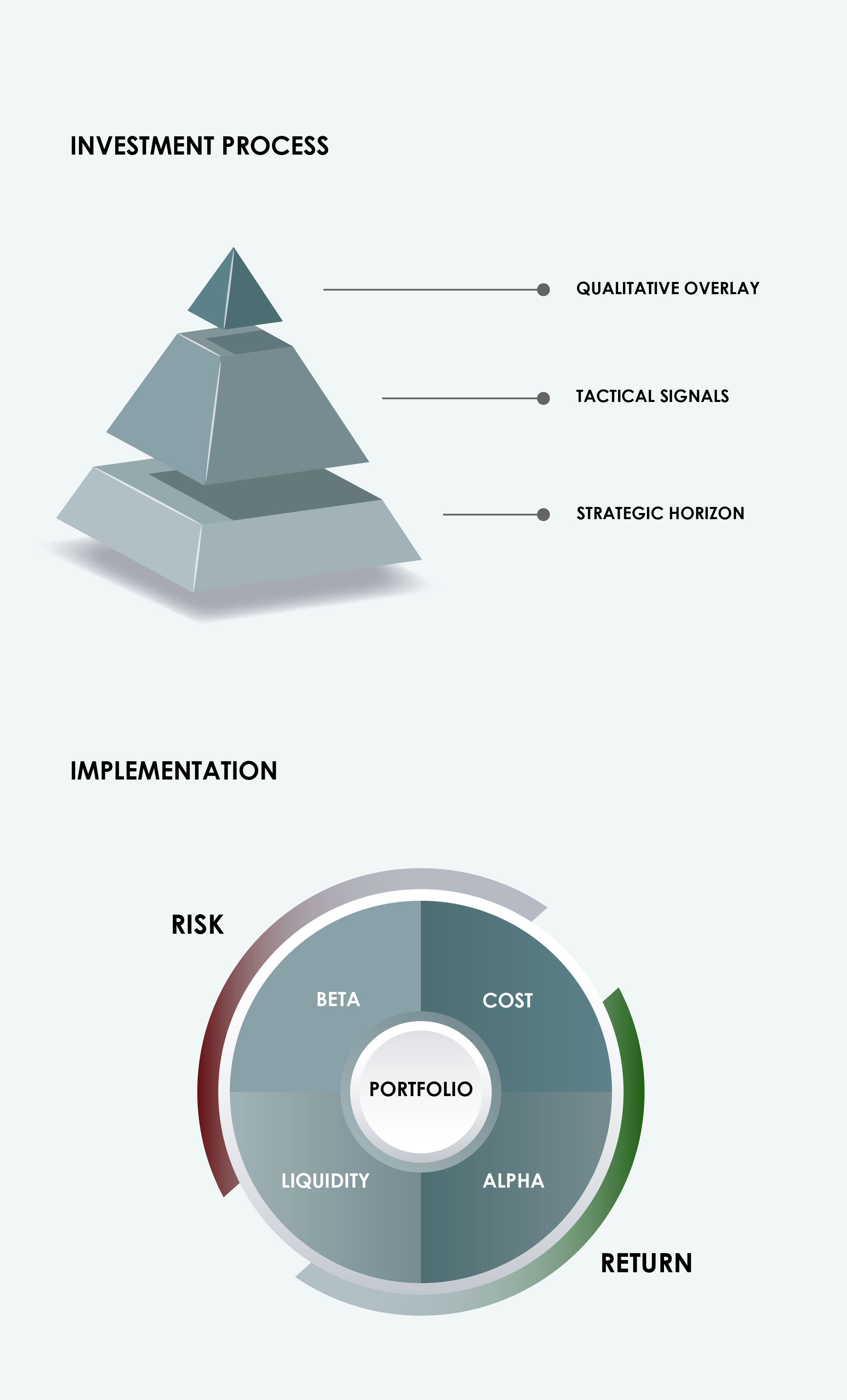

A multi-layer approach to balance long-term performance objectives with dynamic risk management.

1. Strategic Horizon

We begin with a proprietary 5-year strategic model that forecasts long-term returns for major asset classes.

2. Tactical Signals

Short-term (3–6 month) adjustments are made through tactical signals based on momentum, carry, value, and volatility. These signals inform deviations from the strategic allocation to reflect current market dynamics.

3. Qualitative Overlay

We apply a qualitative overlay to align the portfolio with the prevailing macroeconomic and geopolitical environment, ensuring our positioning remains context-aware and responsive.

4. Portfolio Implementation

-

Beta: Selection of market exposures offering strong risk-adjusted returns.

-

Alpha: Determination of the required active return to meet objectives, guiding the choice between active and passive strategies.

-

Liquidity: Assessment of investment vehicle liquidity against expected returns and investment horizon.

-

Cost: Analysis of total cost of ownership relative to anticipated alpha and net returns.

Wealth Management Investment Process

Model Portfolios

CdR's model portfolio is strategic and long term, with pockets of convexity to enhance returns. It is largely quantitative in nature, based on historic market data and serve as a reference point for building our clients' individual portfolios.

Portfolio & Client Specifics

Our clients expect a thorough understanding of their goals and time horizons as well as their operational, regulatory and fiscal constraints.

Only after we have analysed the full spectrum of client goals do we propose portfolio or transactional solutions.

Risk

We continue to monitor all client assets and sources of risk whether related to counterparties or the market.

Execution

We will execute in the manner best suited to matching our clients’ goals precisely, whilst minimising total costs.

Reporting

We monitor performance and provide consolidated reporting across all of our clients’ bank platforms enabling clients to see every custodian at a glance.

CdR Consolidated Reporting

Our team offers comprehensive consolidated reporting capabilities designed to provide clients with a holistic view of their portfolios across all custodians.

Leveraging our sophisticated portfolio management system, we seamlessly integrate data from diverse sources to deliver accurate, timely, and transparent insights.