Current systematic investment landscape

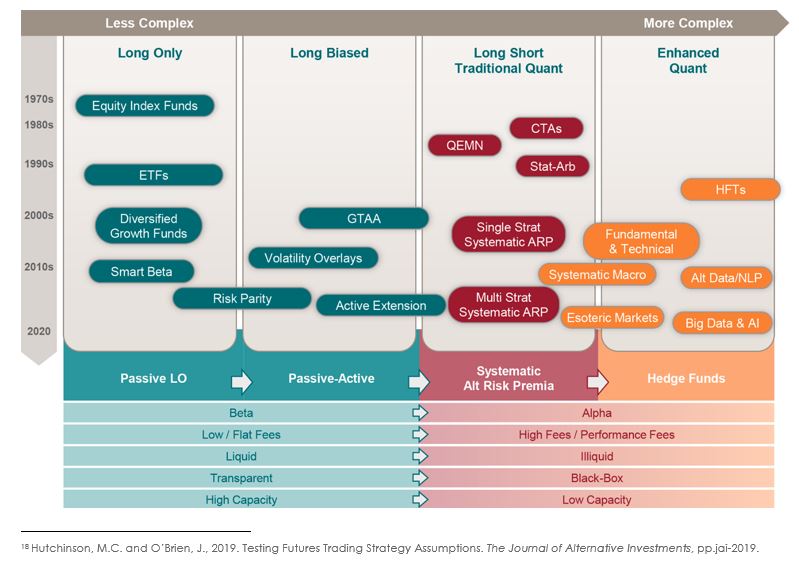

The table below aims to offer a straightforward depiction of the current systematic investment fund landscape.

On the left of the image are strategies that are simple, fully commoditised and long-only that deliver a market beta. On the right are complex, black-box strategies that are expensive to run and deliver high alpha but at higher fees. The traditional quant space is in the middle of the figure. On the top of the figure are the oldest strategies and at the bottom, the most recent.

N.B. The list is not exhaustive and each strategy would have moved towards the left (simpler, more transparent, lower fees) as it became commoditised.

Brief descriptions of common systematic strategies

- Diversified long-only funds allocate (on a long only basis) to an ever-increasing range of instruments across all asset classes including equities, fixed income, credit, commodities and real estate. Risk Parity funds are similar but allocate across asset classes using risk weights rather than expected returns. Global tactical asset allocation (GTAA) strategies invest in diversified long-short positions across the most liquid markets to take advantage of short-term relative mispricing.

- Volatility overlays harvest the volatility risk premium to generate alpha on top of a directional long-only investment in equity and bond markets so as to generate alpha in excess of a benchmark return.

- Active extension funds allocate to long term risk factors in a 130/30 or 170/70 fashion to generate alpha in excess of a benchmark return.

- Trading Advisors (CTAs) are one of the earliest forms of quantitative investing and the strategy originally took directional positions in indices, futures and forwards, based on trend following signals. In recent years, as the strategy has been commoditised, managers in this space have moved into esoteric markets or higher frequency models.

- Systematic Macro has evolved as medium to longer term trend following was commoditised. CTAs have added other types of models, such as short-term mean reversion, quantitative equity market neutral (QEMN), stat-arb, event-driven signals, carry signals, and longer-term multi-asset class value models. This is the blend of traditional CTAs and discretionary global macro investment strategies, usually with longer term holding periods. The strategy combines technical and fundamental data across a very wide range of securities and most recently assets such as CDS, MBS and swaps have been added to the tradable universe. The strategy can take market neutral or directional positions in instruments such as futures, FX, baskets of equities and ETFs and always with a top-down view.

- Systematic Alternative Risk Premia started in the early 2000s, when investment banks offered some alternative risk premia, such as equity momentum and FX carry in a flat fee fully liquid format. Multi asset class strategies, initially constructed using singe strategy bank product, are now offered by an ever-increasing range of asset managers. Such strategies construct a portfolio of commonly known factors that have a positive expected return over the long term. They usually include QEMN strategies, momentum, value, carry and volatility models across a wide range of liquid markets and offer fee-efficient and liquid access to the alternative risk premia space.

- Esoteric Markets have evolved in recent years as the increased diversification provided by less liquid markets has attracted significant interest. Given the reduced analyst coverage, capacity-constrained nature and reduced participation of financial players in these markets, the harvesting of risk premia can be significantly more profitable since price discovery is slower.

- Quantitative Equity Market Neutral is an advancement in risk factor academic research. This strategy uses a range of fundamental financial data to select stocks with large exposures to profitable risk factors. Typically leverage of 4-6x gross is used to build market and sector neutral portfolios with a medium to longer term horizon ranging from four weeks to six months. Originally, traditional factors such as value, quality and momentum were harvested, but as these factors became commoditised, managers in the space begun building traditional factor-neutral portfolios and looking for higher dimensionality factors. In the last decade, managers have begun implementing more event type signals as well as incorporating shorter term mean reversion signals and blurring the line between QEMN and stat-arb.

- Statistical Arbitrage strategies originally focused only on short term frequencies (from one day to four weeks) and used price and volume data to identify relationships within a large universe of stocks. This strategy used correlation, volatility and co-integration techniques to build mean reversion strategies initially in single stocks and over time in futures markets. Investors can think of this strategy as a mean reversion bet on the alpha of a stock vs a multi factor model. In the early-mid 2000s fund managers in this space started implementing fundamental momentum models, as they realised that mean reversion did not occur in the very short-term frequency, in some cases. Fundamental momentum relied on analyst recommendations and other news, which could explain the outperformance of a particular stock vs its peers or industry group. Moreover, managers in the space infused their models with longer term momentum, since this factor has been proven to generate positive excess returns over time. Today, traditional stat-arb can best be described as short-term momentum, medium-term mean-reversion and long-term momentum. This strategy is in the process of being commoditised in the developed market universe with many competing flat fee offerings.

- Fundamental and Technical Models are the second generation of QEMN and Stat-Arb strategies since managers in this space combine short-term momentum, medium-term mean reversion with longer-term quantitative equity-market neutral signals so as to deliver a smoother, more diversified return profile that moves away from traditional risk premia. Such strategies will use additional data sources on flow and events.

- Alternative Data/Natural Language Processing (NLP) is the evolution of fundamental and technical model strategies based on the arrival of significant additional data sets to the market. Managers began incorporating alternative data, such as credit card data or geolocation data, and Natural Language Processing of news or financial statements to build a more accurate picture of a companies’ fundamentals. The early success of these techniques, given they could predict cash flows and therefore the fundamentals of a company with a high degree of accuracy, created a thirst for ever bigger data sets and faster analytical tools such as artificial intelligence (AI). Moreover, strategies started expanding into markets in addition to single stocks. Managers in this space are at the forefront of quant investing using AI as a tool to analyse multi-dimensional datasets rapidly and identify non-linear relationships between securities. These managers, however, may still allocate, directly or indirectly, to traditional risk factors. Sentiment models, through the inclusion of social media datasets, further enhance the shorter-term models. Models here are sometimes difficult to interpret, but are still mainly based on fundamental relationships. Given the large datasets and infrastructure costs, such strategies can be thought of as an ‘arms-race’ and managers must have scale and an appetite for continuous re-investment in technology and data.

- High Frequency Traders (HFTs) are strategies that earn an excess return by providing liquidity in the market. They earn the bid/ask spread and rely on the faster analysis of news/data/market depth so as to get ahead of the street in terms of price moves. Returns are generated by the most efficient execution.

- Big Data & AI is the latest iteration of quant investing and managers in this space are at the cutting edge of research. The signals are generated only through machine learning or artificial intelligence techniques after the analysis of very large data sets. At present such strategies are mainly applied on single stocks, but managers in this space are expanding the application of such models into single name bonds and derivative markets. Capacity in this space is limited and the approach is completely black box as even the managers themselves cannot explain positions or patterns using a simple economic rationale. The models should be orthogonal to traditional and alternative betas as the models are applied on the residual returns after traditional factors are taken into account. Similarly to Alt Data/NLP, this is an expensive strategy to run, and mangers need to continuously re-invest in their business to maintain a cutting edge position. Investors in such strategies should be comfortable with the lack of return, both positive and negative, explainability.

DISCLAIMER

Article for information only. All content is created and published by CdR Capital SA. The views and opinions expressed in this article are those of the author(s). Information on this website is only directed at professional, institutional or qualified investors and is not suitable for retail investors. None of the material contained on this website is intended to constitute an offer to sell, or an invitation or solicitation of an offer to buy any product or service. Nothing in this website, or article, should be construed as investment, tax, legal or other advice.