Citywire: Switzerland Top 50 Independent Asset Managers 2021

Share this article

Philosophy, architecture and psychology are just a few of the disciplines in which Switzerland’s most notable citizens have excelled. However, Jean-Jacques Rousseau, Charles-Édouard Jeanneret, also known as Le Corbusier, and Carl Gustav Jung are not the only ones whose talents have enriched the country.

Wealth management has also shaped Switzerland’s reputation. With an average wealth per adult of $598,410 (CHF 530,311) at the end of 2019, according to Credit Suisse’s global wealth report, the industry continues to flourish.

However, alongside opportunities come challenges. Stricter regulations and consequent increasing cost pressures, as well as the entrance into the market of new players offering services at lower prices, such as fintechs, are just a few of the headwinds today’s independent asset managers are facing.

In 2020, the Covid-19 pandemic and the restrictions imposed to try and control the virus made it even clearer that, in order to survive, companies need to be able to adapt. In addition, due to the large number of companies operating in the sector, competition is fierce and only those who uphold the highest standards will succeed.

In the third edition of the Top 50 Independent Asset Managers, Citywire Switzerland quizzed some of the largest companies across Switzerland and Liechtenstein to understand what drives their success and how they remain competitive.

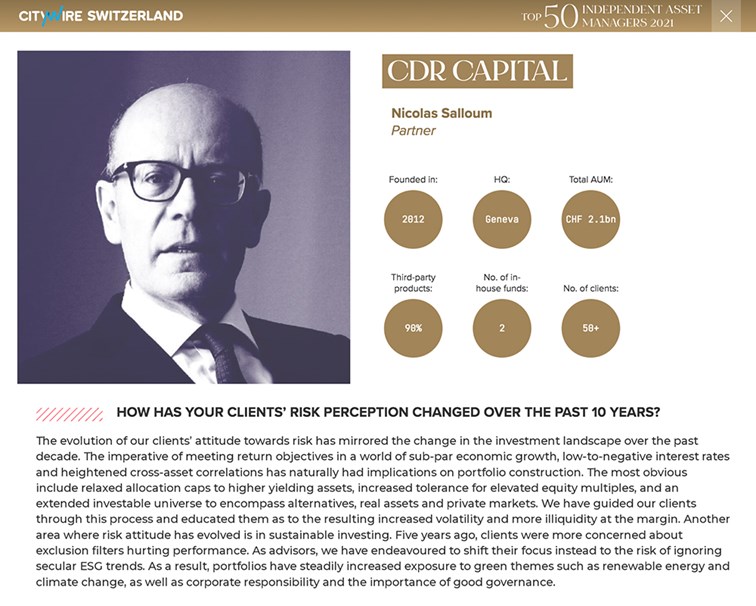

From the challenges of adapting to FinIA and FinSA to business strategies and geopolitical events that hit investments the hardest, CdR Capital was delighted to have been included in Citywire Switzerland's Top 50 Independent Asset Managers in 2021.

In the Citywire article, Nicolas Salloum, Partner at CdR Capital SA, answers the following profile question:

How has your client's risk perception changed over the past 10 years?

"The evolution of our clients’ attitude towards risk has mirrored the change in the investment landscape over the past decade. The imperative of meeting return objectives in a world of sub-par economic growth, low-to-negative interest rates and heightened cross-asset correlations has naturally had implications on portfolio construction.

The most obvious include relaxed allocation caps to higher yielding assets, increased tolerance for elevated equity multiples, and an extended investable universe to encompass alternatives, real assets and private markets.

We have guided our clients through this process and educated them as to the resulting increased volatility and more illiquidity at the margin. Another area where risk attitude has evolved is in sustainable investing. Five years ago, clients were more concerned about exclusion filters hurting performance.

As advisors, we have endeavoured to shift their focus instead to the risk of ignoring secular ESG trends. As a result, portfolios have steadily increased exposure to green themes such as renewable energy and climate change, as well as corporate responsibility and the importance of good governance".

Click here to view full report