Women Behaving Better

Share this article

Are women the solution for the beleaguered banking industry?

“I would rather trust a woman's instinct than a man's reason.” ― Stanley Baldwin, UK politician (1867-1947)

Trying to explain the differences between the sexes, especially if you are a man, is like playing with a loaded gun. Thanks to advances in neuroscience, however, attributing these differences to our brains being wired differently is not only socially acceptable, but actually good business practice.

Diversity on corporate and government agendas is not new, but the pace of change to implementing diversity in the boardroom, for example, now has deadlines. By 2020, not only will Alexander Hamilton’s face on the $10 bill be replaced by a woman, but by then much of the developed world will have hit its ‘females on the board’ quotas according to Credit Suisse's report The CS Gender 3000: Women in Senior Management.

In the US, there is a national initiative called 2020 Women on Boards that is pursuing the goal of increasing to 20% the number of women on boards by 2020. According to the American Banker financial services is even leading the way with, on average, more than 18% of boardroom made up of women.

In Europe, the move is more disparate; France passed a law in 2011 that set strict quotas for gender balance on company boards. By enforcing this law, France can expect 40% of boards to be made up by women by 2017, according to The Local. “In politics, if you want anything said, ask a man. If you want anything done, ask a woman,” according to Margaret Thatcher, former British Prime Minister. Could this mean that the time is now right in France for their first female president?

So how exactly are women’s brains wired to think differently to men’s? A Harvard Business Review spotlight on Women in Leadership (September 2013) took a look at How women decide. Based on University of California, Irvine research, men’s brains had roughly 6.5 times more grey matter than women’s brains. Grey matter contains information processing and goal orientated functions.

Women’s brains have nine times more white matter than men’s brains and white matter is associated with the discovery-orientated part of the brain that connects the dots of the discovery processes. In addition to having more white matter, the cord connecting the left and right lobes is 10% thicker, on average.

The research by Chris Bart and Gregory McQueen from McMaster University takes this one step further to explain that women make better corporate leaders because their brains are wired to make ‘fair’ decisions more constantly (proven by higher scores for Complex Moral Reasoning) when competing interests are at stake. Having a significant proportion of female directors with highly developed CMR skills on the board is important to make such decisions more effectively, Bart and McQueen state.

McKinsey’s Women Matter has explored the role women play in the global workplace, their experiences and impact in senior roles and the performance benefits that companies gain from gender diversity. Women in the economy are one of McKinsey’s key themes.

Since the Credit Suisse Research Institute published its Gender Diversity and Corporate Performance report in 2012 there has been a notable increase in academic research trying to prove whether or not diversity at the board level is reflected in improved corporate financial performance.

According to the Credit Suisse study, which examined all the companies in the MSCI ACWI Index, net income growth for companies with women on their boards has averaged 14% over the past six years, compared with 10% for those with no female director. The net debt-to-equity ratio at companies with at least one female director was 48%, compared with 50% at all-male boards.

One common conclusion to these statistics is that women are risk averse. The Credit Suisse study also showed a faster reduction in debt at businesses with women on the board as the financial crisis and global economic slowdown unfolded.

But the work of Brad Barber and Terrance Odean in Boys will be boys: gender, overconfidence, and common stock investment shows that something else could be at play; something that can, and is, being harnessed in the world of money management. Last week, we saw how testosterone that gives a man his drive can also be, in certain circumstances, the agent of destruction.

Barber and Odean explain that women make better money managers because their lack of testosterone-driven hormone overconfidence does not drive them to over trade. Using common stock investing data from more than 35,000 households in the US, in the time period between February 1991 and January 1997, Barber and Odean concluded that men trade 45% more than women and that trading volume reduces men’s net returns by 2.65% per annum as opposed to 1.72% for women.

They believe that it is the testosterone-fuelled overconfidence that drives this excess trading, which in turn dampens performance when compared to the lower trading volumes but higher returns of women. Barber and Odean also found that a single man is even more overconfident and this makes him trade 67% more than a single woman and on average this reduces comparative returns by 1.44% per annum.

The idea that women money managers perform better than men is not new, but their main challenge has been to gain the visibility and investor access that their male peers enjoy when it comes to asset raising. In conjunction with its most recent research Breaking Away: The Path Forward for Women in Alternatives (September 2015), KMPG has taken up the ‘visibility’ gauntlet and teamed up with Hedge Fund Research to launch the HFRI Women Index.

Made up of more than 60 single manager funds owned or managed by women, the HFRI Women Index has outperformed both the HFRI and the HFRX composites of hedge fund performance nearly every year since 2007 when HFR first launched its diversity indices.

Since 2007, the annualised returns of the HFRI Women Index were 5.64%, while the HFRI Fund Weighted Composite returned 3.75% and the HFRX Global Hedge Fund Index was down 0.39%. According to Stephen Foley in the Financial Times this equates to returns of 59% versus 37% since 2007.

With these numbers why wouldn’t an investor take a closer look at women-led or managed hedge funds? Conscious or unconscious biases are likely to be behind the lack of take up in these funds. In her new book Women of the Street: Why Female Money Managers Generate Higher Returns (And How You Can Too), author Meredith Jones talks to top female fund managers to find out what their edge is and what challenges they faced building businesses.

Assuming that all the research is true, then we can conclude that women trade less and perform better when it comes to money management; they take a long term view and thus look at debt differently; women on boards seem to make the stock price perform better; and are much better at taking in different and differing perspectives and coming to a consensus view.

Given that investment banking earnings’ (and the allocation of capital and trading decisions implicit in the business model) are susceptible to the testosterone swings (see Men Behaving Badly), should we be shorting banks or lobbying for more women to run them?

Aside from Ana Patricia Botin, chair of the Santander Group, women don’t run banks, but if they did, could they turn around the beleaguered industry? As the Financial Times pointed out this week, if senior regulators are women, Janet Yellen, US Federal Reserve and Christine Lagarde, International Monetary Fund to name but a few, why shouldn’t there be more senior female executives in the financial services industry?

But attributing success (or failure) of anything simply to gender alone could be missing the point. What gender diversity is really about is marrying (excuse the pun) the different characteristics of brain and behaviour between the sexes to create a sustainable blend of long term success. Understanding Brains: Details, Intuition and Big Data are becoming the next big business.

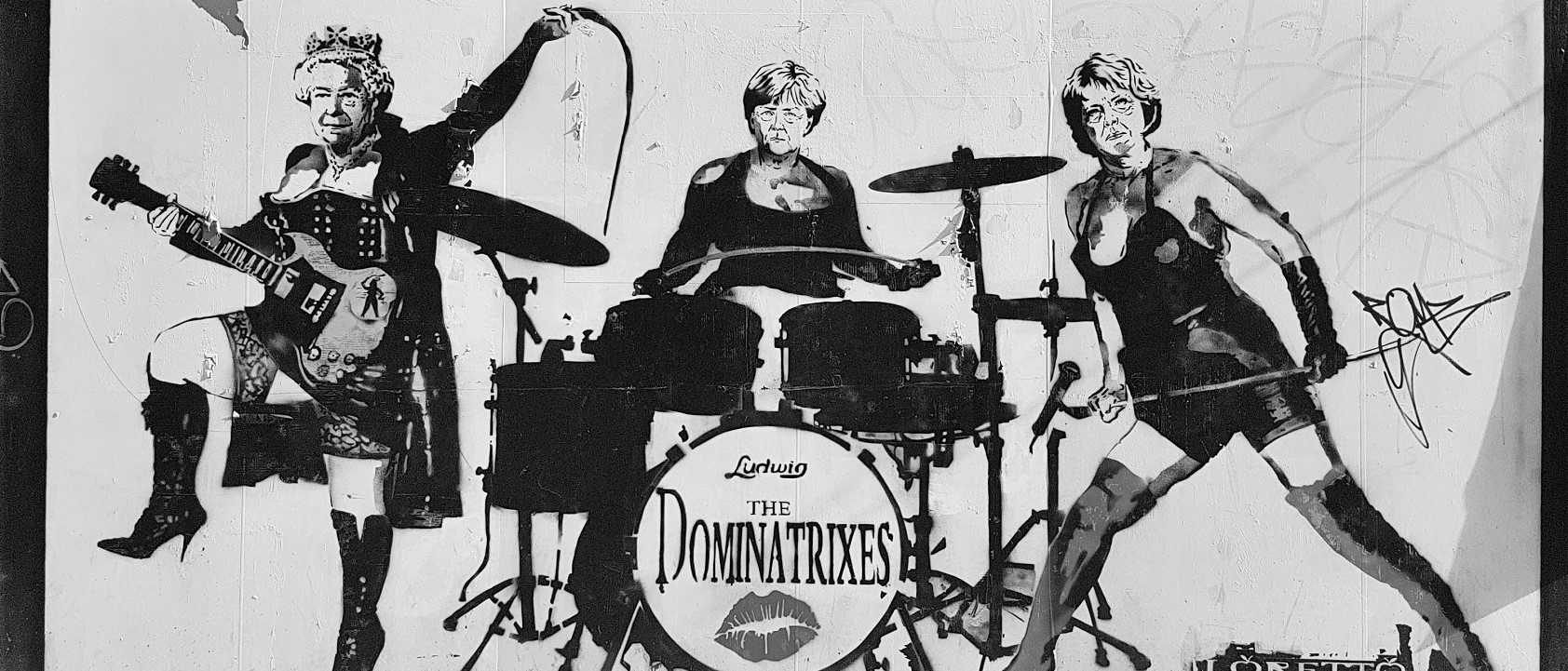

Photo: © Niki Natarajan 2018

Artist: Loretto

Article for information only. All content is created and published by CdR Capital SA. The views and opinions expressed in this article are those of the author(s). Information on this website is only directed at professional, institutional or qualified investors and is not suitable for retail investors. None of the material contained on this website is intended to constitute an offer to sell, or an invitation or solicitation of an offer to buy any product or service. Nothing in this website, or article, should be construed as investment, tax, legal or other advice.

Related articles

The XX Factor

The Queen has reigned for 67 years. Communism has risen and fallen. The Beatles have come and gone, Britain is 5th most economically powerful nation. Women CEOs drive 3x the returns as S&P 500 firms run by men. Why is workplace inequality still a subject?

A World of Risk

“I violated the Noah rule: Predicting rain doesn’t count; building arks does” - Warren Buffett. Can you live in harmony with risk? The consensus is that if you can measure risk, you can manage it. But how do you pick which risk to manage?

Men Behaving Badly

The financial world does not have the greatest of reputations. Reckless behaviour frequently plastered all over the tabloid press, while the broad sheets analyse complex derivative trades gone sour. All the usual soap boxes blame 'men behaving badly'.