Investor Activism

Share this article

Making Money Talk

"We do not inherit the earth from our ancestors, we borrow it from our children" – Native American Proverb

Into the august, wood-panelled room full of senior academic figures and veteran finance-industry alumni, walks an 18-year-old with questionable dress sense and worse hair. He has a single question: when will the college’s charitable endowment disinvest entirely from carbon extraction industries?

This undergraduate is not interested in the facts or the opportunity cost to the endowment of these actions. He is not here to discuss; despite centuries of fact-based and reasoned debate at the institution in question. In fact, this student has an ultimatum; “do it or I’ll go to the press”.

One year later, the foundation was carbon neutral. There is no doubt that this story will be recognisable to foundations, endowments, insurance companies and public pension plans all over the world.

The youth, who feel they have nothing to lose, are fighting for the future of the planet and have co-opted finance as their mechanism for change. In fact, the fossil fuel divestment movement started on university campuses in the US in 2011 and Leeds Trinity University recently became the 76th UK university to commit to it.

Today, even John D Rockefeller‘s foundation that made its wealth in oil, is divesting and while the $1 trillion Norwegian oil fund is not removing the entire $35 billion in oil and gas shares from its equity benchmark index, the world’s largest sovereign wealth fund is still planning to remove $7.5 billion that is invested in exploration and production company stocks¹.

Momentum has gathered in the wake of the 2015 Paris Agreement with the Republic of Ireland the world’s first country² to agree to sell off its fossil fuel investments and the $24 billion Swedish arm of Norwegian life insurer Storebrand becoming the latest asset manager to no longer own stakes in such firms.

It’s clear we are beyond the tipping point. Capitalism has been bad for human equality and worse for the planet. It’s time to change. And the finance industry, now maybe mindful of the challenges of investing purely for investment returns, has embraced that change.

What’s more the change is coming from the top down too. Under its new president Christine Lagarde, the European Central Bank is pushing to include climate change considerations in a monetary policy review³; the European Investment Bank plans to end fossil fuel lending; and soon-to-be-former Bank of England Governor Mark Carney will be the UN Special Envoy for Climate Action and Finance.

Carney aims to transform climate finance by building frameworks for financial reporting and risk management to bring the impacts of climate change to the mainstream of private financial decision-making.

Being socially and environmentally conscious is now a risk-mitigation strategy. ESG controversies have wiped $500 billion⁴ of the value of US companies in five years and climate-related risks topped the World Economic Forum’s 2019 global risk ranking. The environmental risk category has become more prominent since risks related to it started appearing in the top five in 2011. Even credit rating agencies are catching on to the impact of ESG risks when rating corporate bonds⁵.

A report by the Global Commission on Adaptation, an organisation launched by UN Secretary General Ban Ki-moon to encourage the development of measures to manage the effects of climate change, concluded that if $1.8 trillion was invested by 2030 into five categories—weather warning systems, infrastructure, dry-land farming, mangrove protection and water management—then it would yield $7.1 trillion in benefits.

So, while divesting captured the attention of passionate students and set a ball in motion, it is only a fragment of what the future of finance needs to look like in a world where returns are still required to fund pension and insurance liabilities, although no longer at the expense of the planet.

Sir Ronald Cohen believes that capitalism is changing: “The world [is] moving towards optimising risk, return and, now, impact”. And how better to make an impact than for the world’s $44.1 trillion in pension fund assets to invest for measurable beneficial social or environmental impact as well as financial returns?

Sir Christopher Hohn, founder of activist hedge fund TCI, has been pushing for investors to drive greater climate-related disclosure and recently sent letters to 10 companies⁶, including Airbus and Moody’s, which do not publish their carbon dioxide emissions.

Institutional investors such as the Church of England and New York State, both of which took on ExxonMobil over carbon emissions⁷, are also taking a more activist approach. They are part of an investor coalition with 373 signatories, including AustralianSuper and California Public Employees’ Retirement System, which represents $35 trillion in assets under management.

Set up to ensure 161 of the world’s largest corporate greenhouse gas emitters (responsible for 80% of emissions) take action on climate change, Climate Action 100+ (a coalition of some of the world’s largest investors managing $32 trillion in assets) has so far persuaded Royal Dutch Shell plan to halve its carbon footprint by 2050⁸ and link its emission targets to executive compensation and BP to align its investments⁹ to the Paris Climate Agreement.

Jeremy Grantham, co-founder of GMO is, not surprisingly, taking a more value-based approach. He sees climate change strategies, including the shift to clean energy, almost as an insurance play that offers the potential for equity-like gains (or higher), inflation protection and diversification.

Globally, divestment combined with the investment in clean energy crossing the $11 trillion milestone in 2019, but are solar, wind and geothermal energy able to support the world’s energy needs? There are at least 11 countries leading the charge on renewable energy that show what’s possible, even if there are still storage challenges.

Costa Rica, which aims to be carbon-neutral by 2021, has produced 95% of its electricity from hydro, geothermal, solar and wind over the past four years, while Scotland is building the world’s largest wind farm, having powered 98% of its electricity with wind during the month of October 2018.

Sweden has stated it will eliminate fossil fuels from electricity generation by 2040 and has ramped up investment in solar, wind, energy storage, smart grids and clean transport, while in the first half of 2018, Germany produced enough renewable energy to provide electricity to every household in the country for a year.

As Earth Overshoot Day—the date on which resource consumption for the year exceeds earth’s capacity to regenerate those resources that year—edged into July in 2019 for the first time, it is clear that the momentum for change is happening at every level from the individual through companies and to entire nations.

We cannot be far from a world where every one of us tracks and can monitor not just our actual footsteps but also our impact on, and consumption of, the scarce resources of our planet. As anyone used to booking an EasyJet flight knows, a single click on the app offers you the opportunity to offset your carbon footprint.

But EasyJet has gone one step further and just become the world’s first major airline to operate net-zero carbon flights across its entire network. It will offset all jet fuel emissions through avoiding the release of additional carbon dioxide and schemes to plant trees. And therein lies another investment opportunity: forestry.

Not just an inflation hedging tangible asset, properly managed forestry projects provide timber and a way to offset carbon emissions. Royal Dutch Shell is launching a $300 million forestry programme¹⁰, which includes large forests in the Netherlands and Spain, and will also start offering motorists the option of purchasing carbon offsets when they buy petrol at the pump.

Furthermore, forests, or more precisely the global outcry to the fires and accelerated deforestation—a football pitch every minute—of the rainforests that make up the ‘Lungs of the Earth’ in Amazonia, became a vivid reminder that some assets, despite their geography, belong to the planet.

So when President Bolsanaro’s Nero-esque fiddling whilst the Amazon burnt—if not on his instructions then at least in response to his averted gaze¹¹—what could investors do? With $674 billion in external debt, boycotting Brazilian government bonds was one way to make a statement. And that was precisely what the €205 billion Helsinki-based asset management arm of Nordea did.

Meanwhile VF Corporation, parent to Vans, Timberland and North Face, is no longer buying leather from Brazil, and KLP, Norway’s biggest pension fund, may divest from transnational commodity traders operating in Brazil if they work with deforestation-related producers.

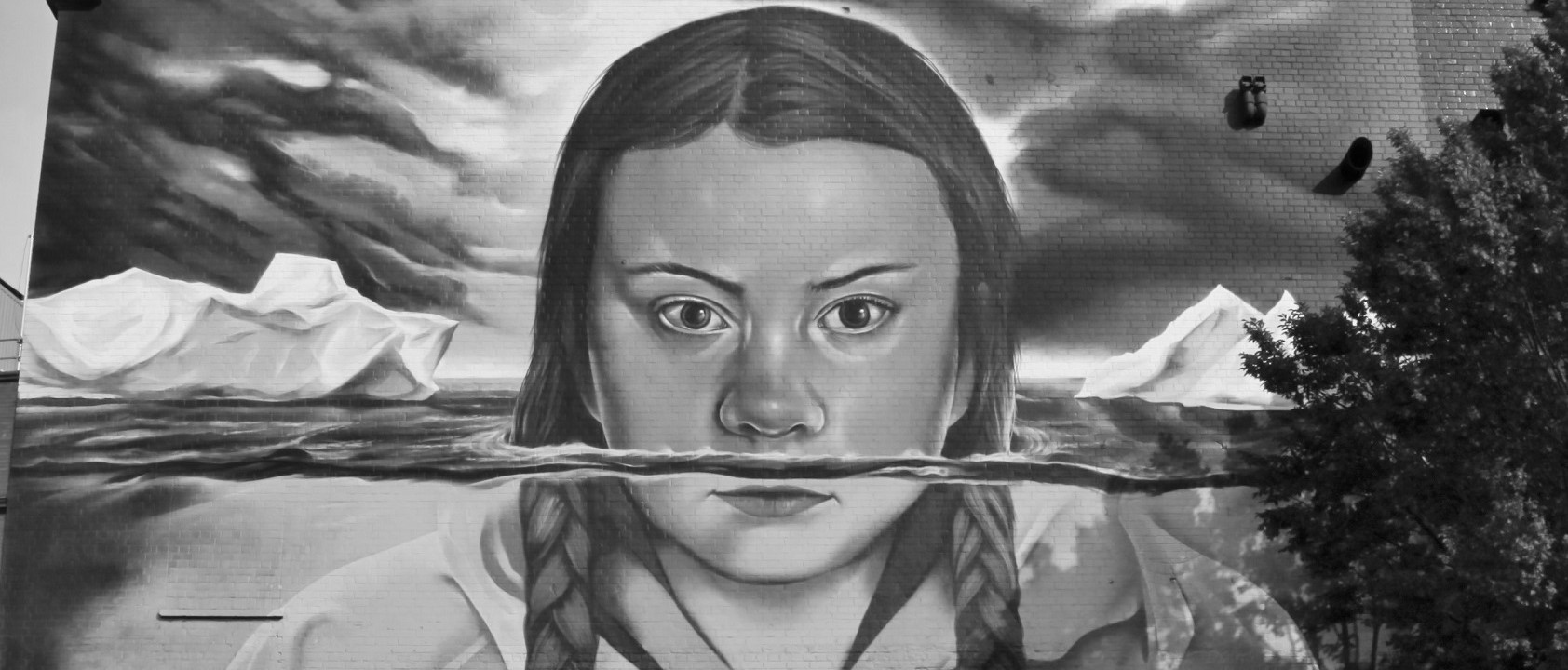

With 246 institutional investors representing approximately $17.5 trillion in assets signing an investor statement on deforestation and forest fires in the Amazon, it would seem the lone undergraduate and Time’s Person of the Year 2019 Greta Thunberg and her global climate-strikers have passed on the climate baton to the grown-ups with dollar-laden wallets.

Photo: © Niki Natarajan 2019

Artist: Jody Thomas

¹ Norway’s $1tn wealth fund set to cut oil and gas stocks, Financial Times (08.03.2019)

² Ireland to become the first country to divest from fossil fuels, Financial Times (12.07.2018)

³ Lagarde’s green push in monetary policy would be a huge step, Financial Times (02.12.2019)

⁴ ESG controversies wipe $500bn off values of US companies, Financial Times (14.12.2019)

⁵ Credit rating agencies turn attention to ESG risk, Financial Times (23.02.2019)

⁶ Companies vow to improve climate disclosure after TCI warning, Financial Times (03.12.2019)

⁷ NY pension fund boss DiNapoli vows to fight on against Exxon, Financial Times (27.05.2019)

⁸ Shell to yield to investor by setting target on carbon footprint, Financial Times (03.12.2018)

⁹ BP shareholders vote in favour of greater climate disclosure, Financial Times (21.05.2019)

¹⁰ Shell launches $300m forest plan to offset carbon emissions, Financial Times (08.04.2019)

¹¹ Saving the Amazon must be a joint endeavour, Financial Times (08.09.2019)

Article for information only. All content is created and published by CdR Capital SA. The views and opinions expressed in this article are those of the author(s). Information on this website is only directed at professional, institutional or qualified investors and is not suitable for retail investors. None of the material contained on this website is intended to constitute an offer to sell, or an invitation or solicitation of an offer to buy any product or service. Nothing in this website, or article, should be construed as investment, tax, legal or other advice.

Related articles

Pollution

Mount Kenya visible Nairobi and some of the most polluted waterways are running clear. The Great Lockdown’s silver lining has been a drop in air pollution and increase in water quality. Is choosing between the economy and our collective health right?

Game of Thrones

Inequality, migration, odd banking system, populist politics and apocalyptic climate change, sound familiar? Replacing zombies with humans surgically attached to smart-phones and Game of Thrones could be an archetypal portrayal of today’s world.

Human Impact

Despite the Doomsday Clock hand remaining at two minutes to midnight in 2019, the imminent threats to humanity and planet continue as we enter a period of ‘new abnormal’. Three of the top five risks by likelihood (and four by impact) are environmental.