Truth, Extremes and Robots

Share this article

Can you monetise anger?

“Without deviation from the norm, progress is not possible” ― Frank Zappa

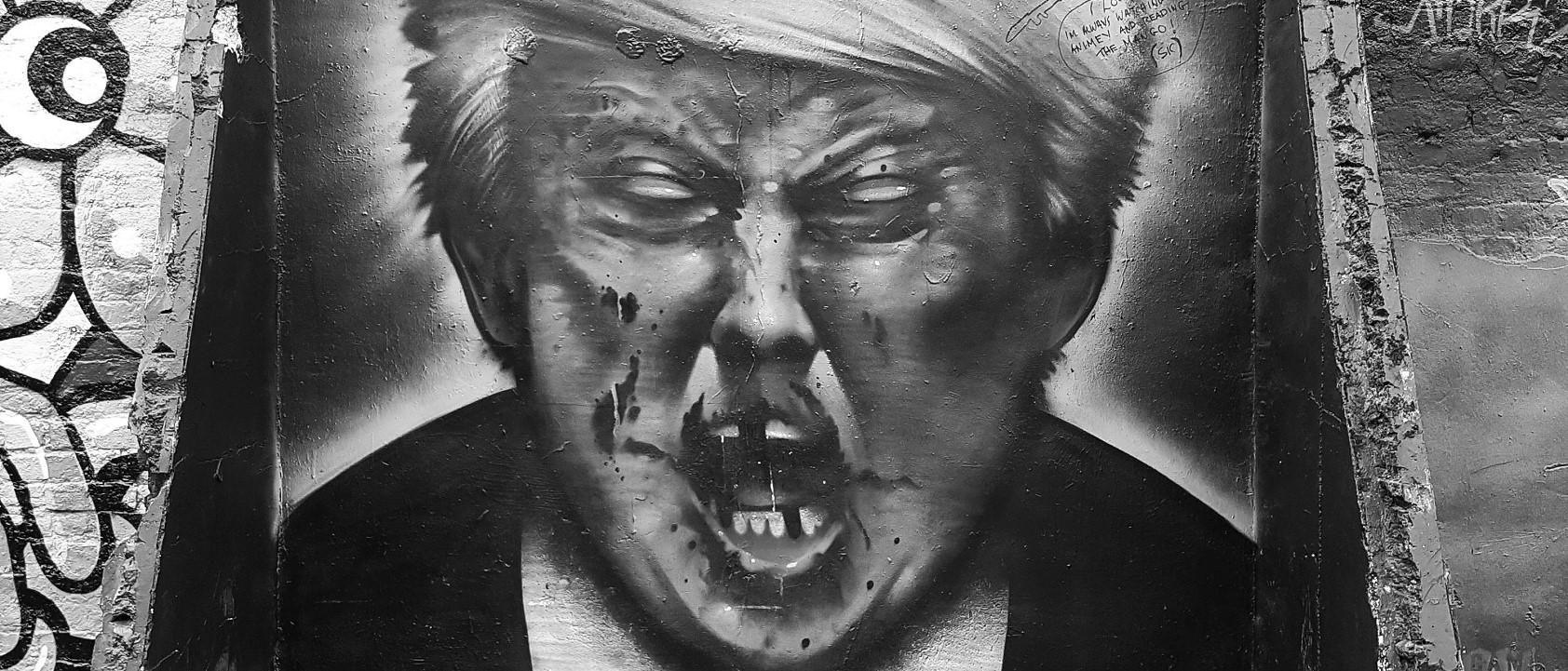

Love him or hate him, Donald Trump understood one thing. The power of anger. During his campaign, Trump perfected, what Matt Frei, author of Only In America, calls ‘the art of bottling the anger and spraying it out when needed’.

By doing this, Trump unleashed the fury of working class America and won the show to become the most powerful person in the world. The people saw a ‘bully’ on their side; one that made millions so ‘he must be ok’. ‘He’s upset, we are really upset’ is a classic way to build rapport.

Populist rhetoric is not about solutions it is about pointing out the problems and inciting anger. We are living in A World of Risk that continues to widen the gap between rich and poor. Europe’s refugee crisis simply helped to highlight The Age of Extremes in which we now live.

Many were surprised with the outcome, but we have a hunch that had the Millennial voters been able to vote via an app, the Euro Clash result would have been different.

Brexit clearly touched a chord with Americans, the majority of whom pay little attention to politics in the UK. A year ago, in a bar featured in Michael Cimino’s film The Deer Hunter, Frei heard a line he never expected to hear anywhere in America: "GO BREXIT! You Brits DID it. You took your country back. We're gonna do the same with Trump!"

And this anger is global. For a moment, it saw populist hopeful Geert Wilders in with a chance to be Prime Minister in the Netherlands. It keeps Narendra Modi in charge in India. But it was a skirmish by angry French voters¹ at Whirlpool’s factory that highlighted true price of globalisation.

We watch with bemusement the dissonance between rising anger and the falling volatility levels in major asset markets and wonder when this will change. The French and Dutch may have missed the ‘bad’ populism but the anger of the people still exists.

Populism’s Paradox is just that; pointing out that jobs are at risk but no one in charge is discussing The Unpalatable Truth: we are close to "peak welfare". With No Entry the mantra for much of the West, globalisation’s march may have been halted (at least temporarily).

But with Apple, Amazon, Microsoft, Facebook and Alphabet among the biggest firms in the world by market capitalisation, it is easy to conclude that the impact of technology giants has not stopped. And driving their march is the data-driven digital revolution.

This has only just begun: data mining is the new extraction industry. As artificial intelligence and autonomous learning become mainstream tools and big data becomes smart data, the Rise of the Robots will continue. Repeatable process in all industries will be automated.

Some jobs will be lost but new jobs will be created. The extremes of the ‘haves and haves not’ depicted in the film Elysium are unlikely, but it is easy to see why those workers affected by automation might be angry.

Yet new industries do emerge. For a while now, we have been living in the Peer to Peer Economy, where Uber and Air BnB, among the largest providers of services, own no assets.

Today’s business model is all about brand and leasing; a concept that Trump’s businesses capitalise on. Indeed, this is a concept that is likely to gain momentum in financial services. A couple of years ago we asked Are Banks Broken? and How disrupted is the Banking Industry?.

With the ascent of FinTech, the banking industry is undergoing a period of change. Whether it is Revolution or Evolution still has to be seen. Today, platforms, whether they are robo-advisers or lending platforms, are leading the charge in offering clients’ solutions rather than just products.

In the meantime, investors still need somewhere to invest and the Asset Allocation game has changed. Protectionist policies from the populist West is likely to provoke a period of global currency volatility.

In the US at least, tax cuts will lead to increased public deficits and so weaken the US dollar, while the social initiatives and increased public spending on infrastructure, promised to the people by their new populist leaders, is going to fuel already upwardly trending inflation.

Make no mistake, Trump may have made Fake News a headline, but the truth is that Western Governments may have been systematically understating inflation.

Brexit and Trump are all about closing borders and retreating behind regulatory and rhetorical barriers. But for how long can Totalitarianism’s Trojan protect an essentially fragile (and bankrupt) social system from technological innovations of the Silicon valley.

For now, we see opportunities in Latin America, Trump’s unwanted back yard. Is Democracy Looming here? For all the negative headlines, Brazilian assets continue to perform.

We must not forget that the populist momentum is often a powerful catalyst for change. In the meantime, Alexander Ineichen’s words still ring true: “The flow of capital is always towards freedom and opportunity and away from repressive and kleptocratic regimes”.

Taking all our 2017 themes together, our instinct is that market volatility levels will not stay at current low levels for much longer.

Photo: © Niki Natarajan 2017

Artist: Tom Blackford

¹ Angry French voters muscle into the picture (27.4.2017), Financial Times

Article for information only. All content is created and published by CdR Capital SA. The views and opinions expressed in this article are those of the author(s). Information on this website is only directed at professional, institutional or qualified investors and is not suitable for retail investors. None of the material contained on this website is intended to constitute an offer to sell, or an invitation or solicitation of an offer to buy any product or service. Nothing in this website, or article, should be construed as investment, tax, legal or other advice.

Related articles

Populism Paradox

It doesn’t matter whether or not Trump wins on 8 November because the populism genie is out of the bottle. It is now clear that peak globalisation lies behind us.

No Entry

The failure of the American dream is a resentment that has been building up over decades culminating in the ‘unlikely’ rise of Donald Trump, whose rhetoric mirrors and exploits the economic anxiety, demographic resentment and fears for border security.

The Age of Extremes

What kind of world do we live in? This is the most fundamental of investment questions. By this we typically mean “what is the outlook for inflation and economic growth?” Sometimes, the question is more socio-economic in nature. Rarely is it existential.