Biotechnology

Share this article

Saviour or Threat?

"Everything depends on the people in the labs. New discoveries in fields such as biotechnology and nanotechnology could create entire new industries” ― Yuval Noah Harari, Sapiens: A Brief History of Humankind

What do bread, acetone, penicillin, yoghurt and Dolly the sheep all have in common? Answer. They are all derivatives of living organisms, the output of an industry that dates back to the fermentation process for beer in China in 7,000 BCE: biotechnology.

In a world united by a fluctuating triplet of constructs: religion, state and capitalism, the latter is sustained by a belief that the future will be better than today. Economic growth depends on it.

Where this belief is absent we turn (with a mix of anger and desperation) to the other two forces: God and Government. And markets fall.

The current technology upswing seems to be in its later stages, with its future growth under threat: Facebook has declining subscribers, Apple is simultaneously losing client loyalty¹ and lengthening the upgrade cycle with their battery issues, and ‘social’ media is being castigated for its addictive and corrosive effects – ‘anti-social’ media.

We look to these things, as much as rising rates, for the market’s recent volatility. So, what will drive the next economic uplift?

According to Yuval Noah Harari, author of Sapiens: A Brief History of Humankind, it is this scientific (and technological) progress that drives productivity. The latest Willis Towers Watson and PRI Global Investment’s Investment Institutions Trend Index attests to this too.

The 2017 report Responding to Megatrends highlights five key trends that will impact the global economy and financial system and technological advances are identified as the first of the five. Within technological advances, digitisation, artificial intelligence, FinTech and biotechnology are named as the four sub-trends.

What new wonders do the technologists and scientists have in store? We have written extensively about robotics, artificial intelligence and FinTech, already on a well-trodden iterative journey to a new world. While likely to be a structural part of the future, are they game-changing from a future-growth perspective?

Harari believes this honour will go to people in white laboratory coats. “New discoveries in fields such as biotechnology and nanotechnology could create entire new industries, whose profits could back the trillions of make-believe money that the banks and governments have created since 2008. If the labs do not fulfill these expectations before the bubble bursts, we are heading towards very rough times."

Honing in on biotechnology, just one branch of the increasingly complex and interrelated field of bioscience (often referred to as life sciences), provides a rich insight into just what kind of opportunities are ripe for the picking.

Indeed, biotechnology companies raised nearly $71 billion in 2015, according to EY’s Beyond borders 2016 – Biotech financing hitting peak returns in July 2015² when the NASDAQ Biotechnology Index rose to 30% on the back of M&A activity and positive drug trials.

The obvious driver for a BioTech boom is the same as that which threatens the welfare state, namely increased life expectancy. The latter is something that Google is investing in with Calico, its BioTech research and development company, founded in 2013 to combat aging and associated diseases.

BioTech, however, is notoriously volatile and sensitive to the actions of the regulators. A fear of Hilary Clinton winning the US elections in 2016, and with it stamping tough regulations on drug pricing, saw the sector suffer losses of some 25% before recovering after Donald Trump’s election.

The index, currently on an upward trend on the back of biopharma, a large component of the NASDAQ Biotechnology Index, having a record number of drug approvals under Trump’s new FDA commissioner Scott Gottlieb.

Fresh in his job, Gottlieb also saw in the approval of three new gene therapies, including one for inherited retinal disease that can lead to vision loss and blindness.

Biopharma, which makes up a large component of the NASDAQ Biotechnology Index, is one sector that benefits from advances in biotechnology with cash flow coming in when the FDA approves a drug, or BioTech equipment.

Defined by the 1992 UN Convention on Biological Diversity as ‘any technological application that uses biological systems, living organisms, or derivatives thereof, to make or modify products or processes for specific use’, biotechnology is also the biology umbrella science for developments in genetic engineering, sequencing and therapeutics as well as synthetic biology.

For this reason, biotechnology was highlighted by World Economic Forum as one of 12 key ‘emerging technologies’ of the Fourth Industrial Revolution to watch in 2017. To look at the ramifications of this, let’s look at biotechnology through the lens of one strand: synthetic biology.

Historically, simply selecting the best crops and animals created a purer strain naturally. Then with the advent of DNA hybridisation, genetic modifications started. But with synthetic biology, new organisms can now be built from building blocks of DNA.

The commercial applications are a potential Aladdin’s cave. Imagine the impact of creating a biofuel from the E. coli bacteria or using plant nanobionics to create bespoke organisms that can act as sensors for pollutants and explosives or mutant mosquitoes that could eradicate malaria?

This is not the realm of fantasy. All of these ideas and thousands more are in various stages of development and to a lesser extent trials. Therein lies the first challenge for investing in this ‘emerging technology’. Which project does one pick?

In Sapiens , Harari posits the following quandary as he describes how science, politics and economics are interconnected.

“Two biologists from the same department, possessing the same professional skills, have both applied for a million-dollar grant to finance their current research projects. Professor Slughorn wants to study a disease that infects the udders of cows, causing a 10% decrease in their milk production. Professor Sprout wants to study whether cows suffer mentally when they are separated from their calves.”

Harari then asks “Assuming that the amount of money is limited, and that it is impossible to finance both research projects, which should be funded?”.

From an economic point of view, the answer is obvious. From an investment perspective ‘emerging technologies’ bring with them the inherent risks of investing in any new market. Biotechnology companies are often characterised by long concept-to-market lead times and no income or dividends in the meantime.

Also according to research, only 9.6% of drugs have a probability of making it to Phase 1 trials and the cost of a failed clinical trial ranges from $800 million to $1.4 billion.

To top it all, not all diseases are considered economically viable. Should the market decide what scientific endeavours to pursue? Oncology start-ups, along with gene therapy and immunotherapy, will continue to be investment winners, according to the recent JP Morgan Healthcare Conference.

Although the majority of BioTech financing goes to US entities (86% in 2015), according to EY, the UK sees itself as a world leader in life sciences, and the sector contributed £30.4 billion to the UK economy in 2015 and supported 482,000 jobs, says PwC’s report The economic contribution to the UK Life Sciences industry.

Steve Bates, chief executive of the UK BioIndustry Association, believes that the UK is set to become the third largest global bioscience hub after Boston and San Francisco. In 2016, £1.13 billion was raised by UK-based BioTech companies from public and private sources, according to Building something great: UK’s Global Bioscience Cluster 2016.

Aiming to both put the UK on the global life science stage and at the same time find way to breathe life back into the beleaguered NHS, Business Secretary Greg Clark and Health Secretary Jeremy Hunt announced a Sector Deal with the life sciences sector at the end of the year.

Following on from Parliamentary Under Secretary of State Lord O'Shaughnessy speech last September on medical technologies as the UK leaves the European Union, the ‘Sector Deal’ will see the UK government support co-investments from 25 organisations.

The aim is to keep the UK at the forefront of developing new innovative treatments and medical technologies to build on its reputation for science and research, genomics and clinical trials. As a cornerstone to this ‘Sector Deal’, a large unnamed US life sciences investment fund plans to invest $1 billion to create a large BioTech company in the UK³.

Aside from giving us the ‘anti-aging’ tools for living longer, there is a possible dark side to biotechnology too. “Biotechnology enables us to defeat bacteria and viruses, but it simultaneously turns humans themselves into an unprecedented threat. The same tools that enable doctors to quickly identify and cure new illnesses may also enable armies and terrorists to engineer even more terrible diseases and doomsday pathogens,” says Harari in Homo Deus: A Brief History of Tomorrow.

Andrew Hessel’s proposed plan to print 3D viruses to attack cancers is ingenious but what are the ‘off-label’ uses of such science? Investing is about the need to balance risk and rewards, something that the World Economic Forum looked at with respect to ‘Emerging Technologies’ in 2015.

Sapiens author Harari believes modern man’s greatest invention is capitalism. So perhaps these risks are worth taking to keep the wheels of capitalism turning.

Omar Ayache

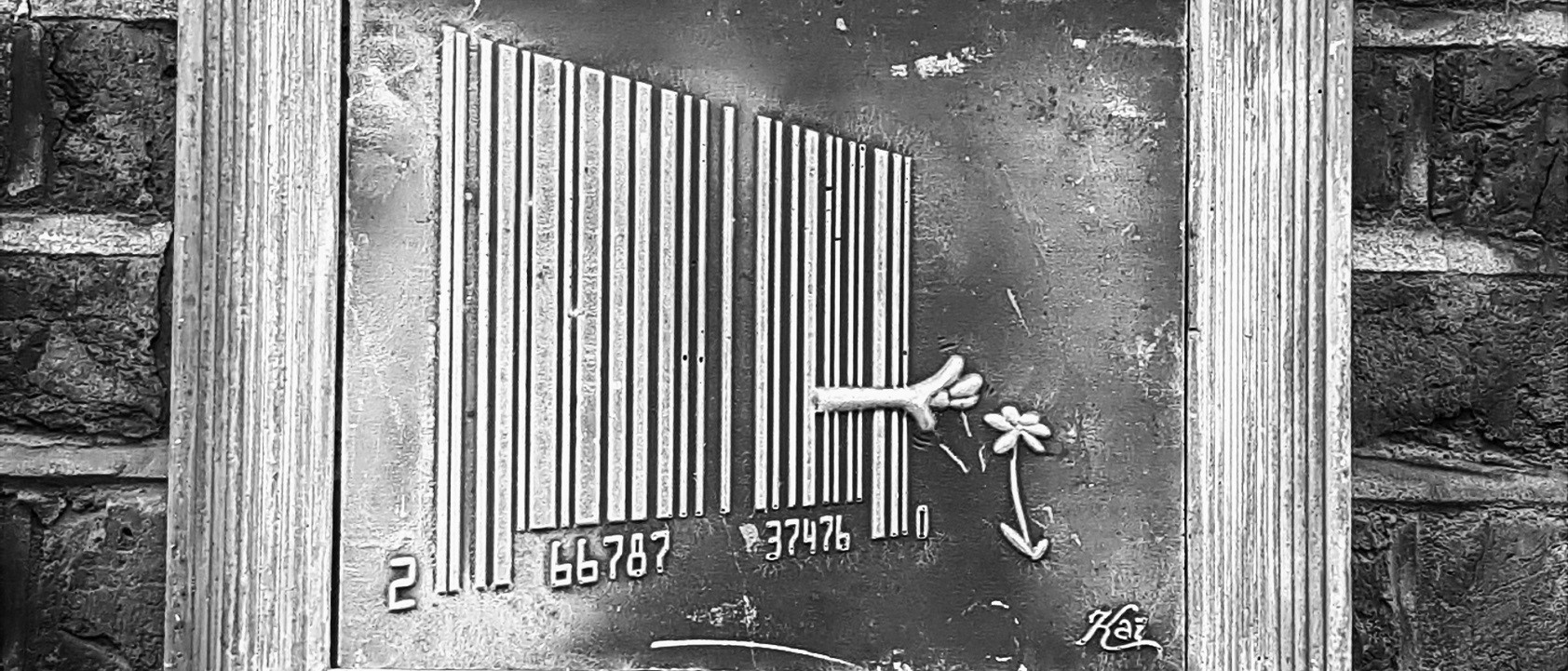

Photo: © Niki Natarajan 2017

Artist: Kai Aspire

¹Apple iPhone slowdown tests consumer loyalty (30.12.2017), Financial Times

²US biotech bull run sets scorching pace (15.7.2015), Financial Times

³US-based fund to invest $1bn in UK biotech (4.12.2017), Financial Times

Article for information only. All content is created and published by CdR Capital SA. The views and opinions expressed in this article are those of the author(s). Information on this website is only directed at professional, institutional or qualified investors and is not suitable for retail investors. None of the material contained on this website is intended to constitute an offer to sell, or an invitation or solicitation of an offer to buy any product or service. Nothing in this website, or article, should be construed as investment, tax, legal or other advice.

Related articles

Swiss Made

“In peace times it is just Switzerland but in war time it is the only country that everybody has confidence in” – Gertrude Stein. Switzerland's brand is precision, quality, reliability and stability. Everything, except for the chocolate, is built to last.

Smart Health

Hugging is potentially lethal and we clap hospital heroes from our homes, many of us realise we have taken the funding and efficiency of our healthcare systems for granted. But health, its data and delivery is changing. What is the future of healthcare?

Covid-19

Exactly one month ago I wrote a mail to my friends and partners and told them, “This is real, and, we are already too late”. I was speaking about the illness we now know as the coronavirus (Covid-19). SARS and insurance/mortality statistics my evidence.